A new batch of BTOs have just released today, and it will be me and H’s fifth try.

I actually blogged here when I first tried for a BTO, but it was always left in draft, uncompleted. I blogged because it was a roller coaster of emotions. I was SO excited the first time H agreed to apply. Excited because H’s agreement to apply a BTO was taken to me, as an “upgrade” of our relationship, a next step. It took much cajoling, and much pains for H to agree. Because then, I was still studying, and H was struggling with work and finances. so he really wasn’t keen. It didn’t make sense to me because, I knew BTO was going to take a long while, and by then I’m sure we would have the financial stability to take on the housing loan. But H in that state of mind couldn’t focus on anything else. But upon application, H actually got more excited than me after that.

sadly, we failed.

H was devastated, way more than me. I was fine. I was pre-warned of all the tough processes in getting a BTO. H, sadly, had to face reality for the first time.

Well, that started our non-stop BTO process. We tried again and again, lowering expectations with every try. I really took on an “okay just apply, don’t expect” attitude. There was even an application which I just told H to apply himself (on our behalf). I didn’t even look through the application or bothered with it. We also tried sale of balance flats- in hopes of getting the leftover BTOs at Woodleigh, but, we were UTMOST SUAY. It was really a week to us going to HDB to select a unit, when the last unit available for CHINESE got taken….really… that’s how bad our luck is with BTOs. sigh.

2 years on, many tries later, we’re still BTO-less, and H is starting to get anxious. (HAHA so much for not listening to me earlier). So much so, we’re actually considering applying resale or private.

So, we actually have been researching for resale flats around Bukit Panjang, and our sole criteria is to be near the MRT. Prices for a 4-room resale flat, with that condition, unfortunately, is 500k-600k even. But the good news is, for resale, our grants would be significantly higher than a BTO. We have a good ~70k of additional grants, and so H thought, that would make the resale option rather attractive. Cause that means 70k into our “CPF” if we do sell the flat eventually.

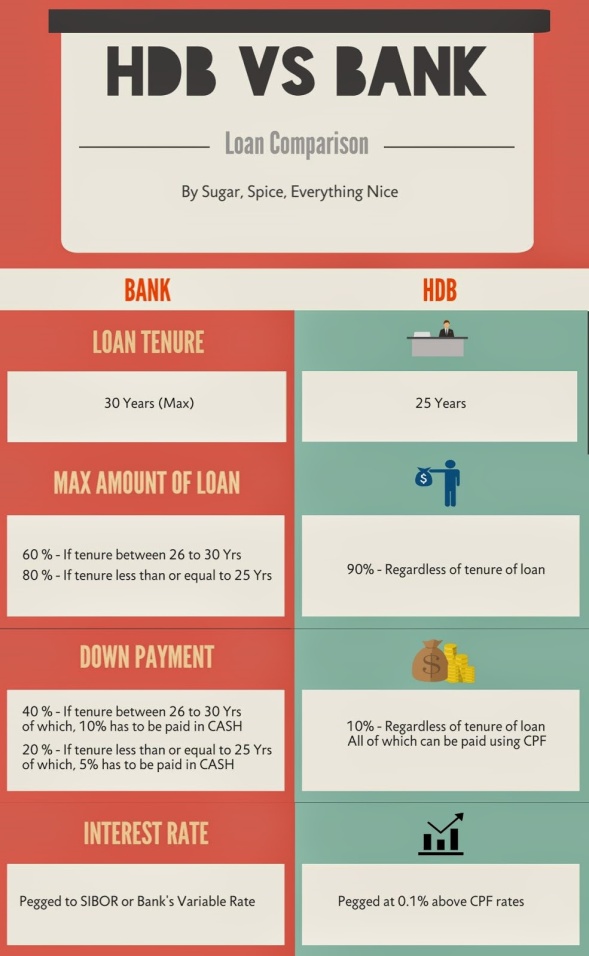

I then called my cousin, a property agent, for advice. She then recommended me the option of private as well. Private properties loans cap are calculated based on TDSR– which is 60% of your gross monthly income, whereas HDBs’ (BTOs & resale) and ECs’ loans are based on Monthly Servicing Ratio (MSR), which is allows for a loan up to a maximum of 30% of your gross monthly income.

Credit: http://executivecondominiums.com.sg/blog/2016/07/27/financing-ec-purchase/

Let me do the maths for you. Assuming we both earn a fresh grad’s pay of 3k each, we essentially can only lend a total of 30% x 6k = $1800 per month. x 25 years (max loan tenure) x 12 months = $540k everything else has to be paid in cash. For BTOs, we don’t have to worry much, cause most 4 room flats (what we’re applying for) will be under 540k. But for resale/ ECs, this will be a different story. Unless you have hundreds of thousands in cash to spare, it’s going to hard to ever buy one.

But for a private property (which can cost rather similar to an EC), with the TDSR calculations, you can loan 60% of 6k = $3600 per month. x 25 years (max loan tenure) x 12 months = 1 million+, so private property is actually within reach. And the advantage of private property- you don’t need to wait 5 years for the Minimum Occupancy Period (MOP) before you can sell. Another potential advantage is that private property’s capital gain is likely higher than a HDB. so if me and h is intending to sell it off, it might benefit us.

BUT WAIT WAIT WAIT! Private property also means, you need to use a bank loan, which requires a 25% of downpayment- TO BE PAID FULLY IN CASH. So even if you can lend up to 1 million, you still need to have at least 250k of cash on hand to pay off a deposit of 1mil. So that’s really going to be pretty impossible….

Credit: http://sugaspiceeverythingnice.blogspot.com/2015/04/differences-between-bank-and-hdb-loan.html

So, without sufficient cash on hand, we really are stuck with BTOs and here we are, trying for the 5th time. We haven’t quite decided which location. H’s keen on woodlands. But I’m still hesitant. It’s really tough adulting and having to learn all these, so here I am documenting my process for whoever is grappling with the same learning curve.